Welcome to my blog! I’m Dilip, and Today, we’ll explore a crucial topic that impacts businesses of all sizes. Equity and Debt Fundraising. Whether you’re starting a new venture, expanding an existing business, or looking for smart investment options, understanding equity and debt financing is key to making the right financial decisions.

Just as individuals need funds for major purchases like a home or car, businesses also require capital to grow. companies also need funds to grow and scale. But where does this money come from? That’s where equity and debt fundraising come into play.

In this guide, I’ll break it down in simple, easy-to-understand terms so you can confidently decide which fundraising option is best for you.

📢 1. What is Equity and Debt Fundraising?

Before we jump into equity and debt fundraising, let’s first understand the basics:

🟢 Equity Fundraising (Ownership-Based Investment)

Equity fundraising means selling a portion of your business to investors in exchange for money. These investors become co-owners and share in your profits and losses.

✅ Example: Imagine you start a tech startup and need ₹50 lakhs to grow. You offer 10% ownership of your company to an investor in exchange for ₹50 lakhs. Now, the investor owns 10% of your business and earns money when your company makes a profit or when its value increases.

🔴 Debt Fundraising (Loan-Based Investment)

Debt fundraising means borrowing money that must be repaid with interest over time. Unlike equity, debt does not dilute ownership—you retain full control of your business.

✅ Example: Suppose you want to open a restaurant and need ₹20 lakhs. You take a business loan from a bank, agreeing to repay it over 5 years with 10% interest. The bank does not own any part of your business, but you must pay back the loan on time.

💡 Simple analogy:

- Equity is like bringing in a business partner who shares your profits.

- Debt is like taking a loan from a friend that you must return with interest.

📢 2. How Do Businesses Raise Funds?

Now that you know what equity and debt fundraising mean, let’s look at the different ways businesses get funding.

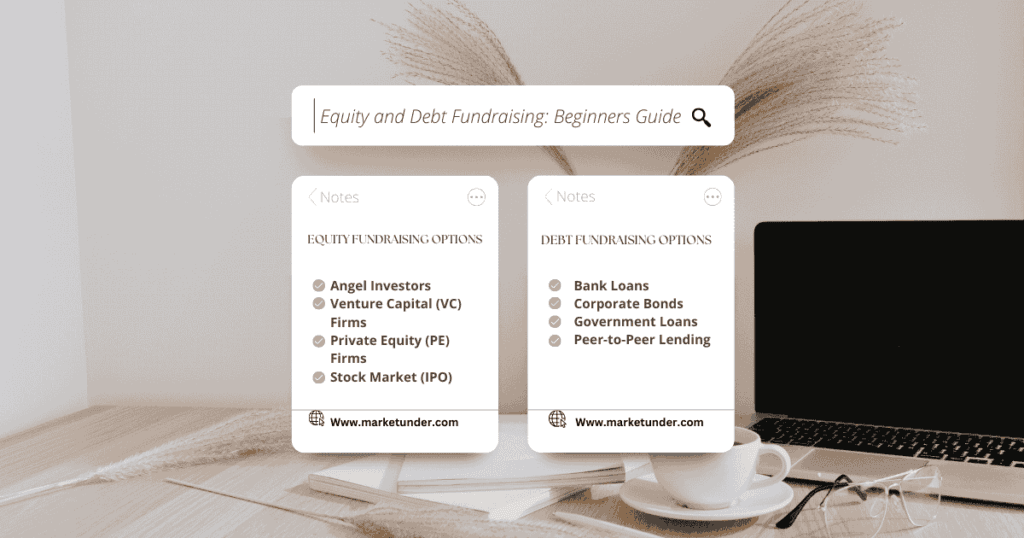

🟢 Equity Fundraising Options (Giving Ownership)

✔ Angel Investors – Wealthy individuals who invest in startups (e.g., Shark Tank investors).

✔ Venture Capital (VC) Firms – Companies that invest in high-growth businesses (e.g., Sequoia, Axel).

✔ Private Equity (PE) Firms – Investors who buy stakes in established businesses.

✔ Stock Market (IPO) – Companies sell shares to the public to raise funds.

🔴 Debt Fundraising Options (Taking a Loan)

✔ Bank Loans – Businesses take loans from banks with interest.

✔ Corporate Bonds – Companies issue bonds to borrow money from the public.

✔ Government Loans – Various government schemes provide business loans, such as MSME loans in India.

✔ Peer-to-Peer Lending – Borrowing from individuals instead of banks.

💡 Quick Tip: Startups usually rely on equity for funding, while established businesses often use debt to expand.

📢 3. Key Differences Between Equity and Debt

| Factor | Equity Fundraising | Debt Fundraising |

| Ownership | Investors own a share of the company. | No ownership is given to lenders. |

| Repayment | No repayment required; investors earn based on business growth. | Must repay the loan with interest. |

| Risk Level | High risk; if the business fails, investors lose money. | Lower risk; lenders must be paid back even if the business struggles. |

| Returns | Unlimited potential returns if the company grows. | Fixed returns through interest payments. |

| Control | Investors may influence business decisions. | The business owner retains full control. |

| Legal Obligation | No legal obligation to repay. | Debt must be repaid, regardless of profits. |

📢 4. Which Option is Best for You?

So, should you go for equity or debt fundraising? It depends on your situation! Let’s break it down:

💼 When to Choose Equity Fundraising:

✔ If you’re running a startup and need capital to grow.

✔ If you don’t want to take on debt and are okay with sharing ownership.

✔ If your business has high growth potential (like tech startups).

✅ Example: Flipkart initially raised money through VC funding (equity) before it was acquired by Walmart.

🏦 When is Debt Financing the Right Choice?

✔ If you want to keep full ownership of your business.

✔ If your business has steady cash flow to repay the loan.

✔ If you need funds for expansion, equipment, or operations.

✅ Example: A restaurant chain might take a bank loan to open more locations instead of selling ownership.

📢 5. Final Thoughts: Choosing the Best Fundraising Strategy.

Choosing between equity and debt fundraising is a BIG decision. The right option depends on:

✅ Your business stage (Startup? Growing? Established?)

✅ Your risk appetite (Comfortable with debt? Okay with sharing profits?)

✅ Your long-term vision (Want full control? Or prefer investors to help you grow?)

Strategic Approach: Many businesses leverage a mix of both equity and debt financing. They raise equity first to fund innovation, then use debt later to expand.

🌟 Summary: Key Takeaways

✔ Equity = No repayment but gives away ownership.

✔ Debt = Must be repaid but you keep full control.

✔ Startups usually rely on equity; established businesses use debt.

✔ The best fundraising option depends on your business stage, financial stability, and risk tolerance.

💡 My Advice? Always weigh the pros and cons before making a decision. If you’re unsure, consult a financial advisor do more research!

If this guide helped you, share it with fellow entrepreneurs and investors to spread financial awareness! who are interested in business and investing. Let’s grow together! 🚀

Till then, keep learning, keep earning, and stay happy as always! 😃

Frequently Asked Questions (FAQ) on Equity and Debt Fundraising

Here are some of the most common questions people ask about equity and debt fundraising.

1️⃣ What is the main difference between equity and debt fundraising?

✔ Equity fundraising involves selling a portion of your business in exchange for money, meaning investors become co-owners.

✔ Debt fundraising is borrowing money (like a loan) that must be repaid with interest but allows you to retain full ownership.

2️⃣ Which fundraising option is better for startups?

✔ Startups often prefer equity fundraising because they don’t have steady cash flow to repay loans. Investors provide capital in exchange for a share of the company, and startups don’t have to worry about immediate repayment.

3️⃣ Do I lose control of my business if I choose equity fundraising?

✔ It depends on how much equity you sell. If you give away a small percentage, you still control your business. However, if investors own a large share, they may have a say in decision-making.

4️⃣ What happens if I can’t repay a debt loan?

✔ If you fail to repay a loan, the lender may charge penalties, increase interest rates, or even seize assets (if the loan is secured). This can harm your credit score and business reputation.

5️⃣ How do investors make money in equity fundraising?

✔ Investors earn money when the company grows and increases in value. They can either:

- Sell their shares later at a higher price.

- Earn dividends (if the company shares profits with investors).

6️⃣ What are the risks of equity fundraising?

✔ If your business becomes very successful, you might feel that you sold equity too cheaply in the early days.

✔ You lose partial ownership of your business.

✔ Investors may want decision-making power.

7️⃣ What are the risks of debt fundraising?

✔ Loans must be repaid on time, even if your business is struggling.

✔ High interest rates can create financial pressure.

✔ Failure to repay may hurt your credit score and lead to legal issues.

8️⃣ Can I use both equity and debt fundraising for my business?

✔ Yes! Many successful businesses combine both methods.

- They start with equity to raise funds without immediate repayment.

- Later, they take on debt when they have steady cash flow to cover loan repayments.

9️⃣ How can I decide which option is right for my business?

✔ Consider these factors:

- Stage of your business – Startups usually choose equity, while established businesses use debt.

- Risk tolerance – Are you okay with repayment pressure or sharing ownership?

- Financial health – Can you afford loan repayments without stress?

💡 Best practice: Talk to a financial expert before making a final decision!

🔟 Where can I find investors or lenders for fundraising?

✔ For equity fundraising:

- Angel investors, venture capitalists, private equity firms, stock markets (IPO).

✔ For debt fundraising:

- Banks, government loans, corporate bonds, peer-to-peer lending platforms.

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be considered financial, investment, or professional advice. While we strive for accuracy, we do not guarantee the completeness or reliability of the content. Always conduct your own research or consult a qualified financial advisor before making any investment decisions. MarketUnder.com and its authors are not responsible for any financial losses or decisions made based on this information.