Earnings Per Share-EPS is a key financial metric that helps investors assess the profitability of a company on a per-share basis. Whether you’re a seasoned investor or just starting, understanding Earnings Per Share-EPS is crucial for evaluating a company’s financial health and making informed investment decisions. In this blog post, we’ll explain Earnings Per Share-EPS in simple terms, break down its significance, and show you how to interpret it for smart investing.

At its core, Earnings Per Share-EPS is a measure of a company’s profitability. It tells you how much profit a company makes for each share of stock outstanding. Earnings Per Share-EPS is a widely-used indicator that helps investors understand how much earnings they can expect from owning shares in a company.

- Basic EPS: This represents the net income (profit) divided by the weighted average number of shares outstanding during a period.

- Diluted EPS: This takes into account any potential dilution of shares, such as stock options or convertible securities.

EARNINGS PER SHARE-EPS is a crucial metric for investors because it directly reflects a company’s ability to generate profits. Higher Earnings Per Share-EPS values often indicate that a company is doing well, while lower Earnings Per Share-EPS values can signal trouble.Earnings Per Share-EPS is also used to calculate the Price-to-Earnings (P/E) ratio, which is one of the most common valuation metrics for stocks.

How to Calculate EARNINGS PER SHARE-EPS?

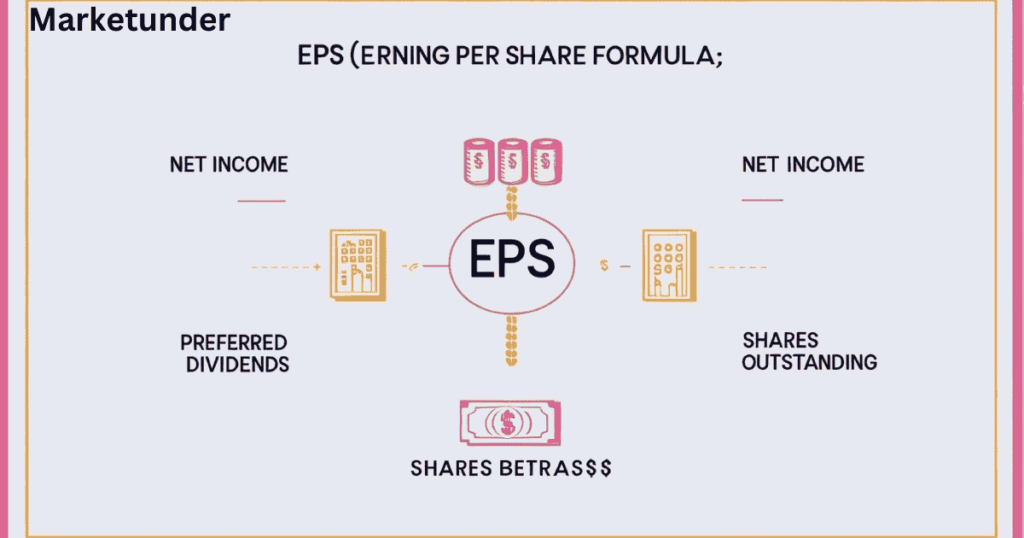

To calculate Earnings Per Share-EPS, you can use the following formula:

EPS=WeightedAverageSharesOutstandingNetIncome−PreferredDividends

This formula divides the company’s net income (after deducting any preferred dividends) by the weighted average number of shares outstanding. The resulting figure represents the earnings attributable to each common share.

- Basic EPS: Simple calculation, as shown above, and it doesn’t account for potential changes in share count.

- Diluted EPS: Takes into account additional shares that could be issued from stock options, convertible securities, and other dilutive instruments.

While Basic Earnings Per Share-EPS is useful, Diluted EPS provides a more conservative estimate, showing what earnings would look like if all potential shares were issued.

Strategies for Interpreting EPS Effectively

1. Compare EPS with Industry Peers

One of the simplest and most effective ways to gauge whether a company’s Earnings Per Share-EPS is good or bad is by comparing it with others in the same industry. This strategy helps put a company’s performance into context, as industry norms can significantly vary.

Practical Tips:

- Research and identify the average Earnings Per Share-EPS for companies in the same sector.

- Look for trends: Has the company’s Earnings Per Share-EPS been increasing or decreasing over time relative to others?

- Consider external factors like market conditions, competition, and industry growth.

Real-World Example: Imagine you’re analysing a tech company, XYZ Corp. Their current Earnings Per Share-EPS is $5.00. When compared to the average EPS of other tech companies, say $4.00, XYZ Corp. seems to be outperforming its peers. This suggests that XYZ Corp. is generating more profit per share than the industry average, which is a good sign for investors.

2. Look at EPS Growth Over Time

EPS growth is a key indicator of a company’s ability to increase profits year over year. Steady growth in EPS is usually a sign of a well-managed company with strong financial health.

Practical Tips:

- Analyse EPS growth over multiple quarters or years.

- Track both the percentage growth in EPS and any seasonality (for example, do earnings increase significantly in certain quarters due to holiday sales?).

- Pay attention to periods of sudden drops in EPS, as these could indicate trouble.

Real-World Example: Consider a company like Coca-Cola. Over the past five years, Coca-Cola’s EPS has consistently grown from $1.50 to $2.00. This shows that the company has managed to increase its profitability, signaling effective business strategies and positive financial performance.

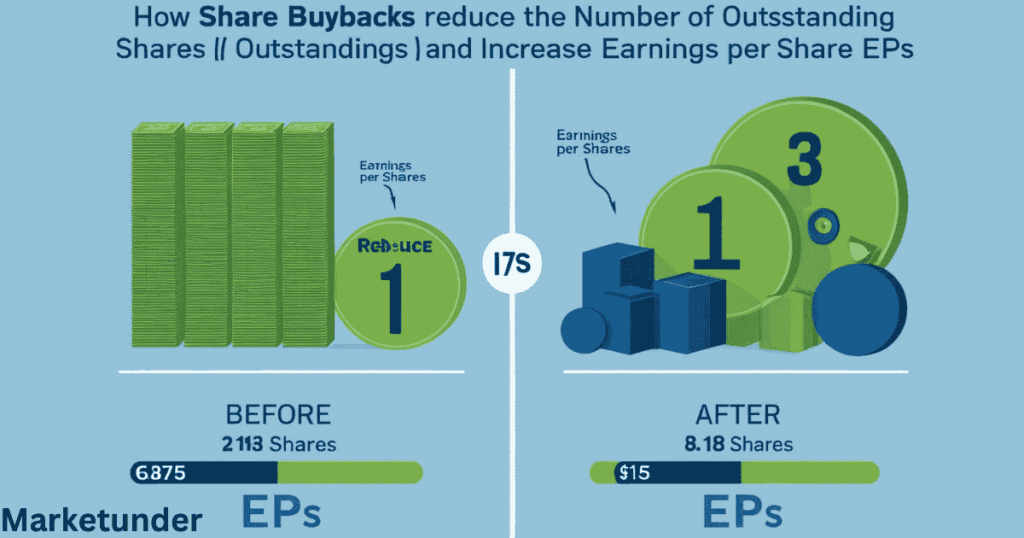

3. Monitor the Impact of Share Buybacks

A share buyback (or share repurchase) occurs when a company buys back its own shares from the open market. This reduces the number of outstanding shares and can increase EPS, even if the company’s earnings haven’t changed.

Practical Tips:

- Check for any announcements regarding share repurchases in the company’s financial reports.

- Compare EPS changes before and after a buyback to see its impact.

- Consider the long-term effects of buybacks on the company’s financial health.

Real-World Example: Let’s say a company, ABC Inc., has 100 million shares outstanding. If ABC Inc. buys back 10 million shares, the remaining 90 million shares will now share in the company’s profits. This could result in an increase in EPS, even if net income stays the same.

4. Evaluate the EPS Relative to Earnings Estimates

Many companies issue earnings guidance or estimates for future periods. Investors should compare the reported EPS with analysts’ expectations. If a company beats expectations, the stock may rise, while missing expectations can lead to a decline in stock price.

Practical Tips:

- Research the company’s EPS estimates before earnings reports are released.

- Watch for any upward or downward revisions to earnings estimates, as these can provide insight into the company’s expected performance.

- Track the company’s track record of meeting or exceeding earnings estimates.

Real-World Example: Apple Inc. reports an EPS of $3.00 for the quarter, beating analysts’ estimate of $2.80. As a result, the stock price jumps by 5% the next day, signaling strong investor confidence in Apple’s performance.

5. Understand the Impact of Non-Recurring Events on EPS

Certain non-recurring events, such as asset sales, legal settlements, or tax benefits, can skew EPS. While these events may lead to a temporary spike or drop in EPS, they don’t necessarily reflect the company’s ongoing profitability.

Practical Tips:

- Pay close attention to whether the company mentions any one-time events that affected EPS in their earnings report.

- Evaluate whether the EPS increase or decrease is sustainable or merely a result of these non-recurring items.

- Look for adjusted EPS, which often excludes the effects of one-time events.

Real-World Example: Imagine that Tesla sells off a portion of its assets and records a one-time gain, causing its EPS to spike for the quarter. While this might seem like a win, investors should recognize that this gain isn’t sustainable, and focus on the core operating performance when assessing Tesla’s profitability.

6. Consider the Quality of Earnings Behind the EPS

Not all earnings are created equal. Companies may employ accounting techniques that boost EPS, but don’t necessarily reflect the true health of the business. For example, a company might use aggressive revenue recognition or defer costs to inflate earnings temporarily.

Practical Tips:

- Review the company’s financial statements and footnotes to understand how they recognise revenue and account for expenses.

- Look for any signs of aggressive accounting, such as rapid revenue growth with minimal profit growth.

- Assess the company’s operating cash flow to see if it’s in line with reported earnings.

Real-World Example: A company like Enron once reported high EPS, but much of its profits were derived from questionable accounting practices. Investors who didn’t dig deeper into the financial statements were misled by the attractive EPS figures before the company eventually collapsed.

Conclusion

Earnings Per Share (EPS) is an essential tool for understanding a company’s profitability and for making informed investment decisions. However, just knowing the EPS number isn’t enough—you need to dig deeper into the context, trends, and external factors that could influence it. By comparing EPS with industry peers, tracking growth over time, and considering non-recurring events, investors can gain a clearer picture of a company’s financial health.

Remember that EPS is just one piece of the puzzle, and it should always be used in conjunction with other financial metrics and qualitative analysis. With this knowledge in hand, you’ll be better equipped to make smarter investment choices and navigate the complexities of the stock market.

1. What is Earnings Per Share (EPS)?

EPS is a financial metric that shows a company’s profitability on a per-share basis. It is calculated by dividing the company’s net income (after preferred dividends) by the number of outstanding shares.

2. Why is EPS important for investors?

EPS helps investors determine how profitable a company is and compare it to industry peers. It is also used to calculate the Price-to-Earnings (P/E) ratio, a key valuation metric.

3. What is the difference between Basic EPS and Diluted EPS?

- Basic EPS considers only outstanding shares.

- Diluted EPS accounts for potential dilution from stock options, convertible securities, and other financial instruments.

4. How can I use EPS to make better investment decisions?

You can compare a company’s EPS with its industry peers, track its EPS growth over time, analyse the impact of share buybacks, and evaluate earnings relative to estimates.

5. Can a company manipulate EPS?

Yes, companies can temporarily boost EPS through share buybacks, aggressive accounting practices, or one-time gains. Always check for non-recurring events and analyze cash flow statements for a clearer picture.

6. What is a good EPS value?

There is no fixed “good” EPS value—it depends on the company’s size, industry, and growth stage. Comparing EPS trends over time and against competitors provides better insights.

7. How often is EPS reported?

Companies typically report EPS every quarter along with their earnings reports. Investors should track these reports to monitor financial performance.

8. What does it mean if a company’s EPS is negative?

A negative EPS indicates that the company is operating at a loss, meaning its expenses exceed its revenue. This could be a red flag for investors, depending on the reason behind the losses.

9. How do stock splits affect EPS?

A stock split increases the number of shares outstanding, which decreases EPS, but the company’s total earnings remain unchanged.

10. Is EPS the only metric to evaluate a stock?

No, while EPS is important, it should be analysed alongside other financial metrics like revenue growth, debt levels, return on equity (ROE), and P/E ratio for a complete evaluation.

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be considered financial, investment, or professional advice. While we strive for accuracy, we do not guarantee the completeness or reliability of the content. Always conduct your own research or consult a qualified financial advisor before making any investment decisions. MarketUnder.com and its authors are not responsible for any financial losses or decisions made based on this information.

2 thoughts on “EARNINGS PER SHARE-EPS-EXPLAINED-2025”