If you’ve ever watched financial news or scrolled through stock market updates, you’ve probably heard the words Sensex and NIFTY being thrown around. But what exactly do they mean? And why are they so important for investors?

Don’t worry—I’ve got you covered! In this guide, we’ll break down Sensex and NIFTY in a simple, engaging, and informative way. Whether you’re a beginner or someone looking to sharpen your market knowledge, this article will give you everything you need to know about these two market indexes.

📍 What Are Sensex and NIFTY?

Think of Sensex and NIFTY as thermometers for the stock market—they tell us whether the market is “hot” (bullish) or “cold” (bearish).

🔹 Sensex (Sensitive Index)

Sensex is the benchmark index of the Bombay Stock Exchange (BSE). It tracks the performance of the top 30 companies listed on BSE, chosen based on market size and liquidity.

- Base Year: 1978-79

- Base Value: 100

- Launched in: 1986

🔹 NIFTY (National Fifty)

NIFTY is the benchmark index of the National Stock Exchange (NSE). It includes the top 50 companies from NSE.

- Base Year: 1995

- Base Value: 1000

- Launched in: 1996

Both indexes represent the overall performance of the Indian stock market. If they go up, it usually means the economy is doing well. If they go down, investors might be worried about economic conditions.

📍 Why Are Sensex and NIFTY So Important?

If you’re investing (or planning to), keeping an eye on Sensex and NIFTY is crucial. Here’s why:

✅ They Reflect Market Trends – A rising index means investor confidence is high, while a falling index signals caution.

✅ They Indicate Economic Health – A strong Sensex/NIFTY suggests the economy is growing.

✅ They Help in Investment Decisions – Investors use them to assess whether it’s a good time to enter or exit the market.

✅ They Impact Mutual Funds & Index Funds – Many funds track these indexes, so their movements directly affect investments.

Just like a weather forecast helps you plan your day, Sensex and NIFTY help investors plan their investments!

📍 How Are These Indexes Calculated?

Both Sensex and NIFTY use the Free Float Market Capitalisation method to determine their values.

🔹 What is Free Float Market Capitalisation?

It’s the total market value of a company’s publicly traded shares (excluding promoter/government-held shares).

🔹 How Are Companies Selected?

- Sensex: Tracks the top 30 companies from BSE.

- NIFTY: Tracks the top 50 companies from NSE.

Companies are selected based on factors like market capitalisation, liquidity, and industry representation. Bigger companies have a higher weightage in the index, meaning they impact its movement more.

For example: If Reliance Industries (a major company) gains 5%, Sensex and NIFTY will likely rise significantly. But if a smaller company gains 5%, the impact will be much lower.

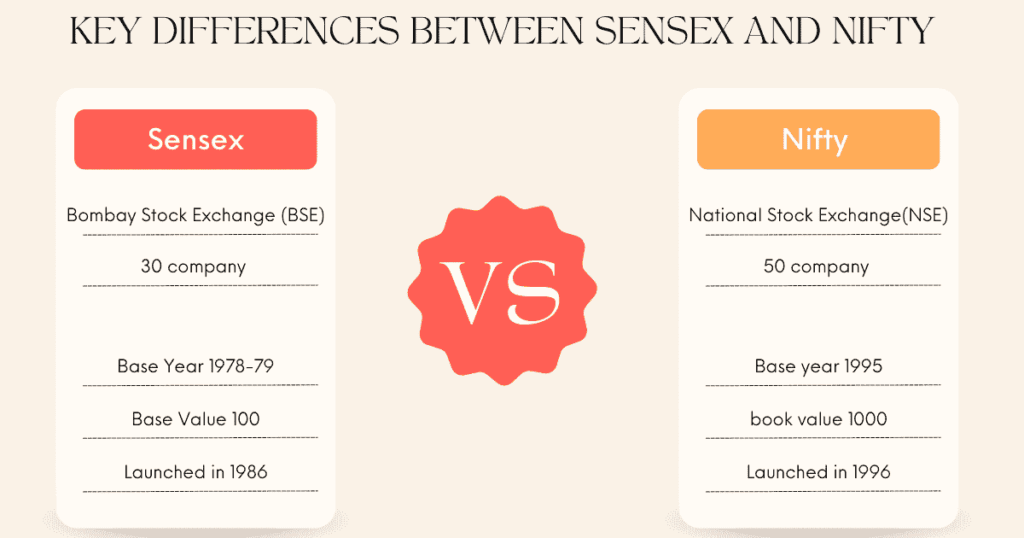

📍 Key Differences Between Sensex and NIFTY

| Feature | Sensex | NIFTY |

| Stock Exchange | Bombay Stock Exchange (BSE) | National Stock Exchange (NSE) |

| Number of Companies | 30 | 50 |

| Base Year | 1978-79 | 1995 |

| Base Value | 100 | 1000 |

| Launched in | 1986 | 1996 |

While both track the stock market, NIFTY covers more companies, making it a broader market indicator.

📍 How Market Sentiments Impact Stock Prices

📌 Stock Prices Move Based on Emotions!

The stock market is not just about numbers and fundamentals—it’s also driven by investor psychology.

🔹 Bull Market 🟢 (Optimism & Growth): When people are confident, they invest more, and stock prices rise.

🔹 Bear Market 🔴 (Fear & Panic): When people are scared, they sell their stocks, and prices drop.

📌 Real-Life Example: The 2008 Market Crash

- In January 2008, Sensex was around 21,000.

- By September 2008, it crashed to 9,000 due to the global financial crisis.

- Even strong companies lost value—not because their earnings dropped, but because market sentiment was negative.

This proves that markets overreact—both positively and negatively!

📌 The Role of Group Psychology

You’ve probably heard the saying:

“All ships rise with the tide.”

Similarly, when the market does well, even weak companies see their stock prices rise. But when the market crashes, even strong companies can suffer.

That’s why understanding investor sentiment is just as important as analysing company fundamentals.

📍 Conclusion: What Should Investors Do?

Understanding Sensex and NIFTY is key to making smart investment decisions. These indexes don’t just reflect stock prices—they tell us about investor confidence, economic health, and market trends.

📌 Key Takeaways:

✔ Sensex = Top 30 companies of BSE | NIFTY = Top 50 companies of NSE

✔ They indicate market trends and investor sentiment.

✔ Calculated using the Free Float Market Capitalisation method.

✔ Markets react emotionally, so sentiment matters as much as fundamentals.

✔ Tracking these indexes helps investors make informed decisions.

What’s your take on Sensex and NIFTY? Let us know in the comments!

📍 Frequently Asked Questions (FAQs)

1. Which is better to track: Sensex or NIFTY?

Both are great indicators! But since NIFTY covers more stocks (50 vs. 30), it gives a broader view of the market.

2. How often do Sensex and NIFTY change?

They update in real-time during market hours!

3. Can I invest directly in Sensex or NIFTY?

Not directly, but you can invest in index funds or ETFs that track them.

4. What happens if Sensex goes up?

A rising Sensex means that most large companies are performing well—a positive sign for investors!

5. What drives Sensex and NIFTY up or down?

Mainly corporate earnings, economic policies, global markets, and investor sentiment.

💡 Like this article? Share it with your friends and fellow investors! 🚀

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be considered financial, investment, or professional advice. While we strive for accuracy, we do not guarantee the completeness or reliability of the content. Always conduct your own research or consult a qualified financial advisor before making any investment decisions. MarketUnder.com and its authors are not responsible for any financial losses or decisions made based on this information.

3 thoughts on “Sensex and Nifty Explained: Beginner Guide”