Hello friends, welcome to marketunder. In this article, we will explain the basics of the stock market for beginners. Learn how to invest in stocks, understand stock market fundamentals, explore trading strategies, and discover investment tips to grow your wealth.

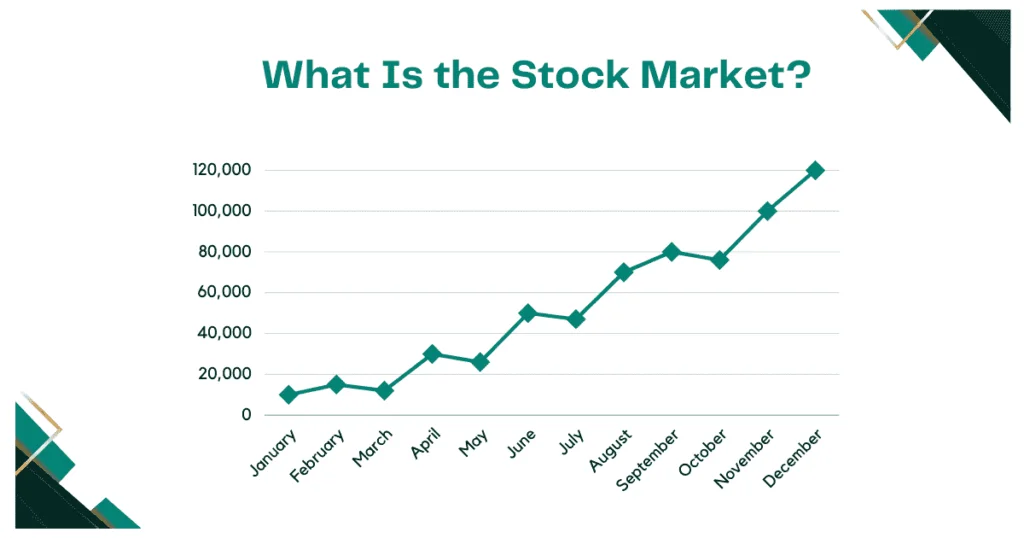

What Is the Stock Market?

The Stock market is a place where investors buy and sell shares of publicly traded companies. The stock market allows businesses to raise capital and gives investors the opportunity to earn profits.

When you buy one share of a company, you’re purchasing a small ownership stake in that company/business. The stock market allows companies to raise capital by selling shares, while on the other hand, investors can potentially profit by buying stocks at a low price and selling them at a higher price.

Two main stock exchanges in India

✔️ Bombay Stock Exchange (BSE) – Bombay Stock Exchange (BSE) is one of the oldest and largest stock exchanges in India. Located in Mumbai, BSE major financial hub where You Buy and Sell stocks, bonds, and other securities. BSE plays a crucial role in India’s financial system, helping companies raise capital by listing their shares and providing a platform for investors to trade those shares.

✔️ National Stock Exchange (NSE) – National Stock Exchange (NSE) is another major stock exchange in India, and it’s often seen as a competitor to the Bombay Stock Exchange (BSE). Based in Mumbai, just like the BSE, and NSE plays a crucial role in the Indian financial system, offering a platform for buying and selling stocks, bonds, and derivatives.

Globally, major stock markets Exchanges:

📌 New York Stock Exchange (NYSE) (USA)

New York Stock Exchange (NYSE) is one of the largest and most well-known stock exchanges in the world, located in New York City. where companies from the USA and around the globe list their shares for trading. The NYSE is often seen as the heart of global finance due to its size, influence, and history.

📌 Nasdaq (USA)

Nasdaq is another major stock exchanges in the United States, and it’s known for being heavily focused on technology and innovation. Compared to the New York Stock Exchange (NYSE), which has a physical trading floor, Nasdaq operates entirely through an electronic system, making it one of the world’s first fully digital exchanges.

📌 London Stock Exchange (LSE) (UK)

London Stock Exchange (LSE) is another oldest and largest stock exchanges in the world. (LSE) based in London, UK, and serves as a key global financial hub for the buying and selling of stocks, bonds, and other financial securities. The LSE plays a major role in facilitating capital flow for businesses and investment opportunities for individuals.

1️⃣ Primary Market (New Issues Market)

Primary Market, also known as the New Issues Market, where securities (such as stocks and bonds) are issued for the first time. It plays a crucial role in helping companies to raise capital by offering new shares or bonds to the public or institutional investors.

2️⃣ Secondary Market (Stock Exchange)

The Secondary Market, also known as the Stock Exchange, is where previously issued securities (stocks, bonds, etc.) are bought and sold between investors. Unlike the primary market, where companies issue new securities to raise capital, and secondary market allows investors to trade existing securities, providing liquidity and the ability to realise returns on investments.

How Does the Stock Market Work?

Stock market is essentially a marketplace where investors buy and sell shares of publicly traded companies. These shares represent partial ownership in a company, and the price of a share reflects what buyers are willing to pay based on the company’s performance, future prospects, and market conditions.

✔️ If more people buy a stock, its price increases due to high demand.

✔️ If more people sell a stock, its price decreases due to low demand.

Key Market Participants:

1️⃣ Investors: Investor is someone who allocates capital (usually money) to an asset, project, or business with the expectation of receiving a financial return in the future. The goal of investing is typically to grow wealth over time through interest, dividends, or appreciation in value.

2️⃣ Traders: Trader is someone who buys and sells financial assets like stocks, bonds, commodities, or currencies, often with the goal of making a profit from short-term price fluctuations. Traders are typically more active in the markets than investors, who may hold assets for the long term.

3️⃣ Stockbrokers: Stockbroker is a licensed professional who buys and sells stocks and other securities on behalf of clients. They act as intermediaries between individual investors and the stock exchanges where these securities are traded. Stockbrokers can work for brokerage firms, or they may be independent.

Must-Know Terms for the Stock Market

📌 Stock (Equity): Stock (equity) refers to a share in the ownership of a company. When you buy stock, you’re purchasing a small part of that company, making you a shareholder.

📌 Sensex & Nifty: Sensex and Nifty are key stock market indices in India that track the performance of a group of selected stocks, providing a snapshot of the overall market’s health.

📌 Bull Market: Bull Market refers to a period in which the prices of securities (like stocks, bonds, or commodities) are rising or are expected to rise. It’s characterized by strong investor confidence, increased buying activity, and optimism about the economy or specific sectors.

📌 Bear Market: Bear Market refers to a period in which the prices of securities, like stocks, are falling or are expected to fall. It’s typically defined as a decline of 20% or more from recent highs, and it’s often accompanied by pessimism, decreased investor confidence, and widespread fear about the economy or particular sectors.

📌 Market Capitalization: Market Capitalization (Market Cap) refers to the total value of a company’s outstanding shares of stock. It’s calculated by multiplying the company’s stock price by the total number of shares in circulation. Market cap is often used as a measure of a company’s size and the relative value of its stock.

Start Investing in Stocks? (Step-by-Step)

Step 1: Open a Demat & Trading Account

Opening a Demat (Dematerialized) and Trading Account is the first step for buying and selling stocks and other securities in the stock market.

✔️ Demat Account – Demat (Dematerialized) Account is an electronic account used to hold and store securities like stocks, bonds, and mutual funds in digital form. It eliminates the need for physical share certificates and makes trading in the stock market more efficient.

✔️ Trading Account – Trading Account is an account that allows you to buy and sell securities like stocks, bonds, and other financial instruments in the stock market. Unlike a Demat account, which holds your securities, the trading account is used to execute buy and sell orders.

Step 2: Fund Your Account

Transfer money from your bank account to your trading account to start investing or trading.

Step 3: Research and Pick Stocks

Researching and picking stocks is a crucial part of investing in the stock market. It involves analysing potential companies to determine which stocks are worth buying based on factors like growth prospects, financial health, and market conditions.

Step 4: Place Your First Trade

Use your trading platform to buy or Sell your first stock.

Step 5: Track and Manage Your Portfolio

Regularly review your investments and rebalance if needed.

How to Choose the Right Stocks?

📊 Analyse Company Fundamentals:

✔️ Revenue & Profit Growth – Revenue and profit growth are two key indicators of a company’s financial health and performance. Investors typically examine both to assess whether a company is expanding, becoming more efficient, and generating increasing returns.

✔️ Debt Levels – Debt Levels refer to the amount of money a company owes, typically through loans, bonds, or other financial obligations. Evaluating a company’s debt is crucial because it impacts its financial stability and ability to grow.

✔️ Dividend Yield – Dividend Yield is a financial ratio that shows how much cash a company returns to its shareholders in the form of dividends relative to its stock price. It’s expressed as a percentage.

✔️ P/E Ratio – Price-to-Earnings (P/E) Ratio is a popular metric used to evaluate the valuation of a company’s stock. It shows how much investors are willing to pay for each dollar of the company’s earnings (profit).

📌 Diversify Your Portfolio

Don’t put all your money in one stock. Instead, diversify across:

✔️ IT & Technology

✔️ Banking & Finance

✔️ Healthcare

✔️ FMCG (Consumer Goods)

Understanding stock Market Trends (Bull vs. Bear Market)

✔️ Bull Market = Stock prices are rising. Investors are optimistic.

✔️ Bear Market = Stock prices are falling. Investors are fearful.

📌 Pro Tip: The best time to buy stocks is during a bear market when prices are low.

Best Investment Strategies for Beginners in Stock Market

📈 1. Long-Term Investing

Long-term investing is a strategy where you hold your investments (like stocks, bonds, or real estate) for 10-20 years or even decades. The goal is to ride out short-term market volatility in favour of benefiting from the general growth and compounding returns over time.

- Buy quality stocks and hold for years.

- Example: Investors who bought Infosys in the 1990s are millionaires today!

📊 2. SIP in Mutual Funds

SIP (Systematic Investment Plan) in mutual funds is a method of investing a fixed amount regularly (monthly or quarterly) in a mutual fund scheme. It’s a popular strategy for long-term investing, as it allows you to build wealth over time with small, consistent contributions.

- Invest small amounts monthly to build wealth over time.

- Best for beginners who don’t want to pick individual stocks.

📉 3. Swing Trading

Swing trading is a short- to medium-term trading strategy where traders aim to capture price swings or fluctuations in stocks, commodities, or other financial instruments. Unlike long-term investing, which focuses on holding assets for years, swing traders typically hold positions for days, weeks, or sometimes a few months, depending on the Stock market conditions.

- Short-term strategy (holding stocks for a few weeks).

- Higher risk but potential for quick gains.

📌 4. Dividend Investing

Dividend investing is a strategy where investors focus on stocks that pay regular dividends—typically a portion of a company’s earnings paid out to shareholders. The idea is to generate a steady stream of income, often in addition to any capital gains from stock price appreciation.

- Invest in stocks that pay regular dividends for passive income.

Stock Market Risks & How to Avoid Them

🚨Stock market Common Risks:

❌ Market Volatility: Stock Market volatility refers to the degree of variation in the price of a financial asset, such as stocks or bonds, over time. Essentially, it’s a measure of how much the market fluctuates—both up and down. High volatility means larger and more frequent price swings, while low volatility signals relatively stable prices.

❌ Emotional Trading: Emotional Trading: Emotional trading refers to making investment decisions based on emotions such as fear, greed, excitement, or panic, rather than on rational analysis. It’s one of the biggest challenges for investors, often leading to poor decision-making. For example, selling stocks in a panic during a market downturn or buying impulsively after hearing about a “hot” stock can hurt long-term performance.

❌ Overtrading: Overtrading occurs when an investor or trader buys and sells too frequently, often driven by emotions like fear, excitement, or impatience, rather than a disciplined strategy. This behaviour can lead to high transaction costs, excessive exposure to market noise, and poor decision-making.

📌 Risk Management Tips:

✔️ Set a stop-loss to limit potential losses.

✔️ Invest only what you can afford to lose.

✔️ Stay updated with market trends and financial news.

Conclusion

Investing in the stock market is one of the best ways to build long-term wealth. Start small, learn continuously, and stay patient.

🔹 Follow a disciplined approach

🔹 Focus on long-term wealth creation

🔹 Avoid impulsive decisions

Start your stock market journey today! 🚀

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be considered financial, investment, or professional advice. While we strive for accuracy, we do not guarantee the completeness or reliability of the content. Always conduct your own research or consult a qualified financial advisor before making any investment decisions. MarketUnder.com and its authors are not responsible for any financial losses or decisions made based on this information.

4 thoughts on “Stock Market Basics: Guide for Beginners”