Hello friends, welcome to marketunder. In this article, we will explain Stock market work in India Step by Step Guide. Have you ever wondered how people build wealth by investing in the stock market? Or why some companies raise billions through IPOs? If you’re a beginner, the stock market might seem complex. But don’t worry—this guide will break it down in a simple and engaging way!

What You’ll Learn in stock market work Guide:

✅ What is the stock market & how Stock market Work work?

✅ How do companies raise money in the stock market?

✅ How can you invest in stocks & make money?

✅ Key stock market terms & investment strategies

✅ How stock prices move & what affects them?

✅ Common mistakes to avoid as an investor

By the end, you’ll have a solid understanding of the Indian stock market work and be ready to start investing! 🚀

1. What is the Stock Market?

The stock market is a place where investors buy and sell shares of publicly traded companies.

Think of it Like a Marketplace:

- Instead of trading vegetables or clothes, you trade company shares.

- When you buy shares, you become a partial owner of that company.

- As the company grows and makes profits, its share price increases, benefiting investors.

Key Stock Exchanges in India

India has two main stock exchanges where shares are bought and sold:

1️⃣ National Stock Exchange (NSE) – The largest exchange by trading volume.

2️⃣ Bombay Stock Exchange (BSE) – Asia’s oldest stock exchange (established in 1875).

These exchanges ensure fair trade under the Securities and Exchange Board of India (SEBI) regulations.

2. How Does the Stock Market Work in India?

The stock market work in two main segments:

a) Primary Market – Where Companies Raise Money

Companies need money to grow, so they raise funds in two ways:

✅ Private Investment – Money from angel investors & venture capitalists.

✅ Public Investment – Issuing shares to the public via an Initial Public Offering (IPO).

Once a company is listed, its shares are available for public trading.

What is an IPO?

An Initial Public Offering (IPO) is when a company sells shares to the public for the first time.

- Example: If a startup needs ₹500 crore to expand, it can go public by issuing shares.

- Investors buy these shares at a fixed price, and the company uses the funds for business growth.

Once listed on the stock exchange, shares can be bought and sold between investors.

- If you buy shares from another investor on NSE/BSE, you’re participating in the secondary market.

- Stock prices fluctuate daily based on demand and supply.

3. Key Stock Market Terms You Should Know

Before investing, you must understand some basic stock market terms:

1️⃣ Face Value (Par Value): Face Value (Par Value) refers to the nominal or original value of a stock set by the company when it is issued. This is usually a small amount, like ₹10 or ₹100 per share, and is not related to the current market price of the stock. It’s primarily used for accounting purposes and may not reflect the stock’s actual market value.

✅ The original price of a stock set by the company during the IPO.

2️⃣ Market Price: Market Price refers to the current trading price of a stock in the stock market. It is determined by the supply and demand for that stock, meaning it can fluctuate throughout the day based on market conditions, investor sentiment, and company performance. This price is what buyers are willing to pay and what sellers are willing to accept.

✅ The current trading price of a stock on the exchange.

3️⃣ Paid-up Capital: Paid-up Capital refers to the total amount of money a company has received from shareholders in exchange for shares. This is the actual capital raised by the company through the issuance of shares, as opposed to authorized capital, which is the maximum amount a company can issue. It represents the funds a company can use for its business activities.

✅ The total money received by the company from shareholders in exchange for shares.

4️⃣ Authorized Capital: Authorized Capital refers to the maximum amount of share capital a company is legally allowed to issue to shareholders. It is decided during the company’s incorporation and can be changed through shareholder approval. Authorised capital represents the upper limit on the total value of shares a company can issue but doesn’t necessarily mean the company will issue all of them.

✅ The maximum share capital a company is legally allowed to issue.

5️⃣ Market Capitalisation (Market Cap): Market Capitalisation (Market Cap) is the total value of a company’s outstanding shares of stock, calculated by multiplying the current market price per share by the total number of shares in circulation. It helps investors assess a company’s size, growth potential, and risk level. Companies are categorised by their market cap: large-cap (stable, lower risk), mid-cap (higher potential, moderate risk), and small-cap (high potential, higher risk).

Market Cap = Total Shares × Current Market Price

- Large-cap companies = Safe investments

- Mid-cap & small-cap companies = Higher risk, but higher return potential

4. How to Start Investing in the Stock Market? (Step-by-Step Guide)

Step 1: Open a Demat & Trading Account

To buy and sell shares, you need:

✅ A Demat Account (Stores shares electronically)

✅ A Trading Account (For buying & selling stocks)

Top brokers to open accounts with:

- Zerodha

- Upstox

- Angel One

- Groww

Step 2: Transfer Funds to Your Trading Account

Once your account is set up, deposit money from your bank to start investing.

Step 3: Research and Select Stocks

Always analyze a company’s:

✅ Financial performance

✅ Future growth potential

✅ Debt levels

✅ Industry trends

Step 4: Buy Stocks Through a Broker

Use your broker’s platform (app or website) to buy shares.

Step 5: Monitor Your Investments

Keep track of stock performance and hold for the long term to maximise profits.

5. How Do Investors Make Money in the Stock Market?

There are two main ways to earn money from stocks:

1️⃣ Capital Gains (Buying Low, Selling High):

Capital gains refer to the profit made from the sale of an asset or investment, such as stocks, real estate, or bonds, when the selling price is higher than the original purchase price. This concept is rooted in the strategy of “buying low and selling high,” aiming to buy assets at a lower price and sell them at a higher price to maximise returns.

Example:

- You buy a stock at ₹100.

- After a year, it rises to ₹150.

- Your profit is ₹50 per share.

2️⃣ Dividends (Passive Income)

Dividends are payments made by companies to their shareholders, typically on a quarterly basis, as a way to distribute a portion of the company’s profits. For investors, dividends represent a form of passive income, as they provide regular payouts without the need for active involvement.

Example:

- If a company declares a ₹5 dividend per share and you own 100 shares, you earn ₹500!

6. What Affects Stock Prices? (Why Do Stocks Go Up & Down?)

Stock prices fluctuate daily due to:

✅ Company Performance – Company performance refers to how well a business is achieving its goals and generating value, which directly impacts its profitability, stock price, and long-term sustainability. Evaluating a company’s performance involves analysing both financial and operational metrics.

✅ Economic Conditions – Economic conditions refer to the overall state of a country’s economy, including factors like inflation, unemployment, interest rates, and economic growth. These conditions can significantly impact a company’s performance, consumer behaviour, and investment opportunities.

✅ Global Events – Global events, ranging from geopolitical tensions to natural disasters and pandemics, can have far-reaching impacts on financial markets, company performance, and investment strategies. These events can cause volatility, shift economic priorities, and alter investor sentiment.

✅ Investor Sentiment – Investor sentiment refers to the overall attitude of investors toward a particular market, asset, or economy. It is driven by emotions, perceptions, and collective psychology, often influenced by factors such as news, market trends, and economic indicators. While investor sentiment is not always based on fundamental analysis, it plays a critical role in market fluctuations.

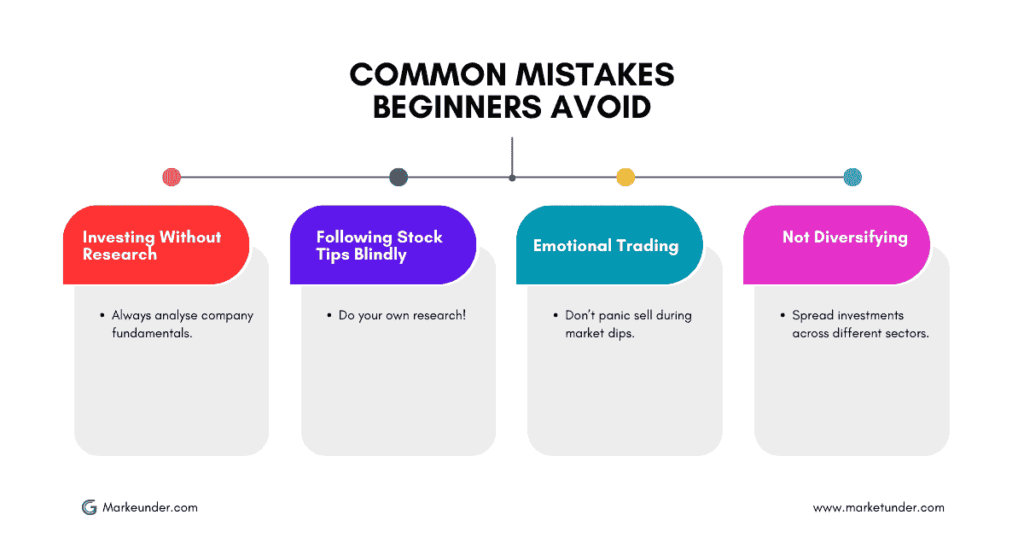

7. Common Mistakes Beginners Should Avoid

🚨 Many new investors lose money due to these mistakes. Avoid them!

❌ Investing Without Research – Many new investors make decisions without fully understanding the companies they’re investing in. It’s important to analyse financials, growth potential, and industry trends before making a purchase.

❌ Following Stock Tips Blindly – It’s easy to get swayed by tips or advice from others, but relying on others’ recommendations without doing your own research can lead to poor investment choices.

❌ Emotional Trading – Buying and selling based on fear, panic, or greed can lead to hasty decisions. For example, panic selling during a market dip may result in selling stocks at a loss.

❌ Not Diversifying – Putting all your money into one stock or sector increases risk. It’s important to diversify across different stocks, sectors, and asset classes to reduce potential losses.

❌ Ignoring Risk Management – Risk management strategies like setting a stop-loss or having an exit plan can help protect your investment. Ignoring these can expose you to larger losses.

8. Best Strategies for Stock Market Investing

1️⃣ Long-Term Investing (Wealth Building Strategy)

Invest in fundamentally strong companies and hold for 5-10 years.

2️⃣ Value Investing (Buy Undervalued Stocks)

Buy stocks trading below their intrinsic value and wait for price appreciation.

3️⃣ Growth Investing (High Growth Stocks)

Invest in companies with high future growth potential, like technology and healthcare.

4️⃣ Dividend Investing (Passive Income)

Choose companies that pay regular dividends for passive income.

Conclusion: Start Your Stock Market Journey Today!

Stock market investing is one of the best ways to build wealth over time.

🔹 Start small, invest wisely, and be patient.

🔹 Avoid common mistakes & follow a strategy.

🔹 Keep learning & improving your knowledge.

Got questions? Drop them in the comments!

Frequently Asked Questions (FAQs)

1. Can I start investing in stocks with ₹500?

Yes! You can buy low-priced stocks or invest in fractional shares.

2. Is investing in stocks risky?

Yes, but risk can be managed with proper research and diversification.

3. What is the best time to invest?

The best time to invest is now—the longer you stay invested, the more wealth you build.

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be considered financial, investment, or professional advice. While we strive for accuracy, we do not guarantee the completeness or reliability of the content. Always conduct your own research or consult a qualified financial advisor before making any investment decisions. MarketUnder.com and its authors are not responsible for any financial losses or decisions made based on this information.